10 Easy Facts About Amur Capital Management Corporation Explained

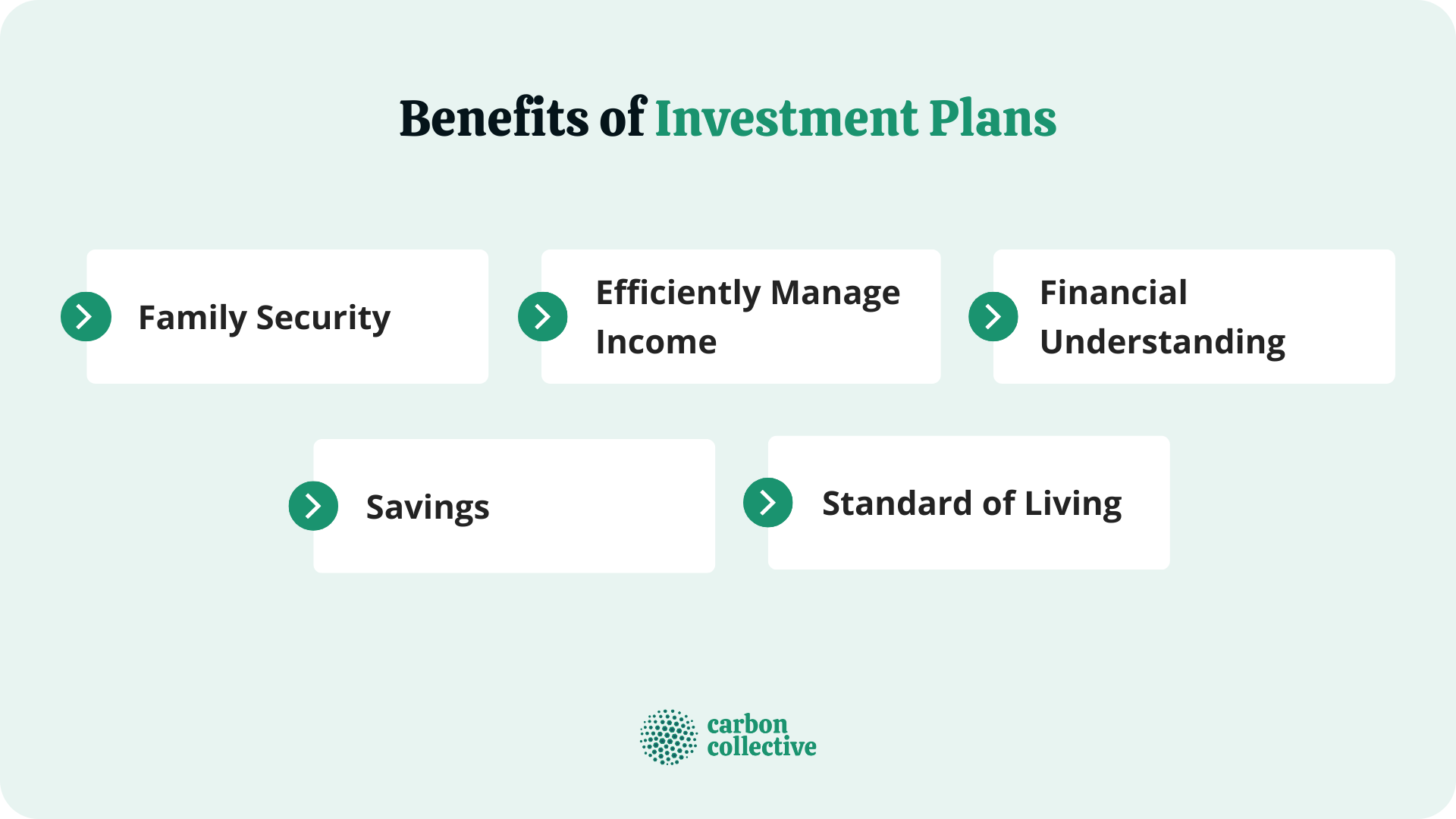

Wealth and financial stability can just be developed through investment. A wise financial investment can boost your cash's worth and surpass rising cost of living.

A lifetime of advantages awaits you when you spend, so there is no factor not to take the plunge. Spending has greater growth potential because of intensifying and the risk-return compromise. Of all, why should you spend rather of just saving money?

Below are a few pros of investing: Investing in quality financial investments can earn you extra income. You may be able to utilize your return on investments as an extra source of revenue on a routine basis.

Not known Details About Amur Capital Management Corporation

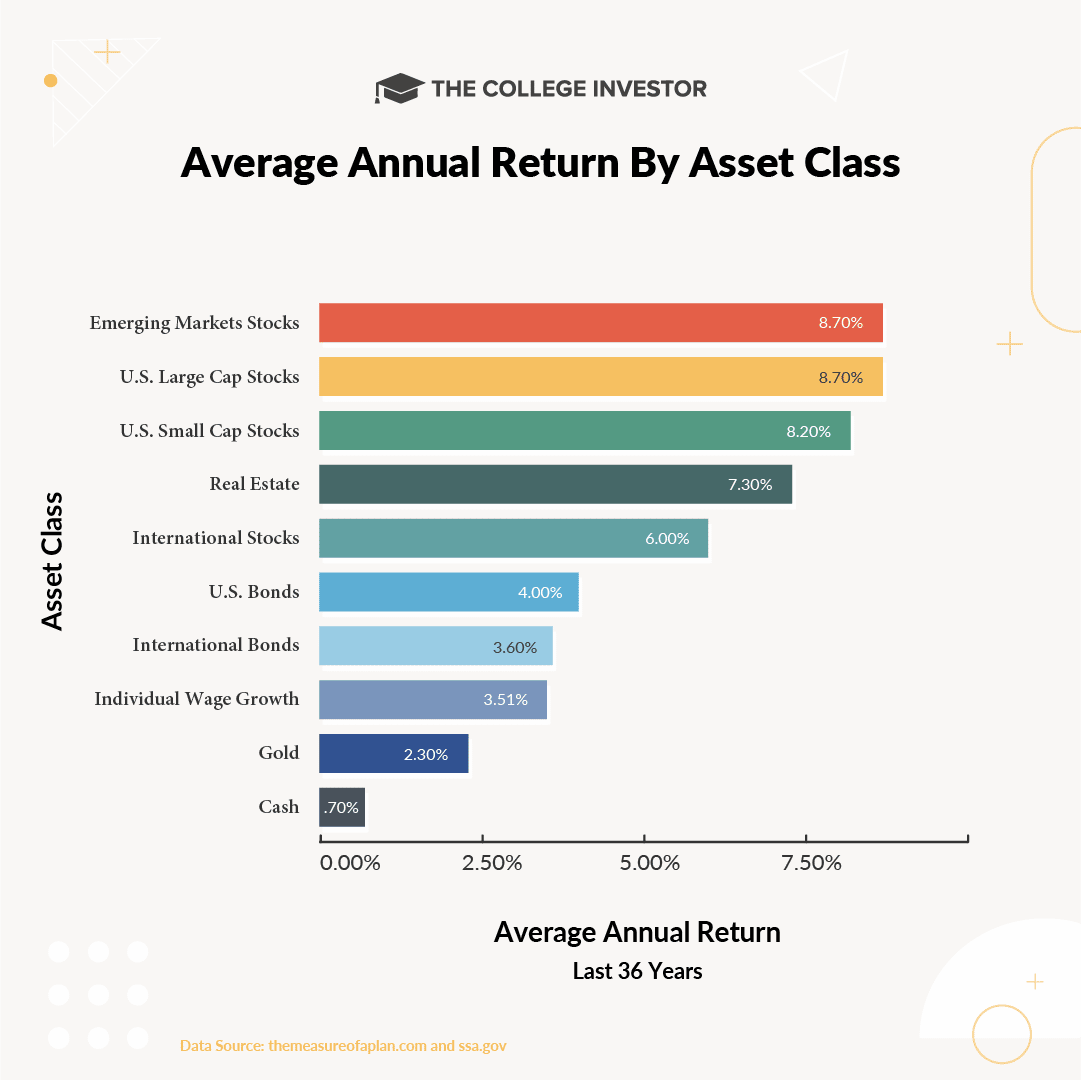

The development of your cash will certainly be achieved by spending it. You can expect to make returns on your money, such as stock, certification of down payment, or bond investments, if you spend for a long time.

Without spending and growing your money, you'll actually shed money gradually. Rising cost of living is accountable for every one of this. Costs increase every year because of rising cost of living, and your money sheds its buying power consequently. Over the past couple of years, inflation has actually averaged around 3%, although the rate can vary widely.

What Does Amur Capital Management Corporation Do?

As paychecks get fatter, consumer demand boosts, resulting in greater profits for firms. By recognizing the four phases of the organization cycle growth, peak, contraction, and trough one can better comprehend exactly how the economic situation functions. When it concerns investing, a typical issue amongst people is the danger of shedding their cash.

The Ultimate Guide To Amur Capital Management Corporation

It is also very helpful to invest due to the fact that this can save you on taxes! Cash spent in a 401k, SEP INDIVIDUAL RETIREMENT ACCOUNT, or Traditional Individual retirement account will not be tired in the year it is earned.

If you 'd instead pay taxes now, you can choose to utilize a ROTH IRA. This alternative lets you pay taxes currently and stay clear of paying tax obligations later on. You can also enjoy lower funding gains taxes in taxable accounts than you would certainly if you worked 9-5! The instances above are simply basic ones.

The Greatest Guide To Amur Capital Management Corporation

Different trading approaches should be thought about before clearing up on an investment. This can be advantageous to capitalists who spend in supplies.

Stock investing has both advantages and negative aspects. There are a great deal of Supply financial investments have traditionally created considerable returns over the long term, however they additionally include substantial risks. It is feasible to diversify the dangers linked with stock investing is possible by purchasing various stocks, fields, and locations.

Head Of State of Saint Financial Investment Team Nic is a two decade seasoned professional in investing and funding raising, specializing in Real Estate and financial debt markets. With Saint Investment Group, he leads large-scale troubled asset purchases and innovative syndications for financiers.

Some Ideas on Amur Capital Management Corporation You Need To Know

The value of financial investments and any type of income is not guaranteed and can go down as well as up and might be affected by exchange price changes - https://www.pubpub.org/user/christopher-baker. This implies that an investor might not get back the amount invested.

Financiers ought to talk to their own specialist consultants for guidance on any financial investment, legal, tax obligation, or accounting concerns associating with a financial investment with Columbia Threadneedle Investments. The reference of any type of particular shares or bonds should not be taken as a referral to deal - investing for beginners in canada. Columbia Threadneedle Investments does not give any kind of investment suggestions

The evaluation included in this paper has actually been generated by Columbia Threadneedle Investments for its own financial investment administration tasks, may have been acted on before publication and is offered below incidentally. Any type of point of views shared are made as at the date of magazine however are subject to change without notice and must not be viewed as investment recommendations.

Amur Capital Management Corporation Fundamentals Explained

None of Columbia Threadneedle Investments, its supervisors, police officers or employees make any kind of depiction, guarantee, guaranty, or various other guarantee that any of these forward-looking statements will prove to be exact. Information obtained from exterior sources is believed to be dependable, but its precision or efficiency can not be ensured. Issued by Threadneedle Property Management Limited.